Fitness App Market is making hearts stronger and minds lighter on a 45.45B journey by 2035

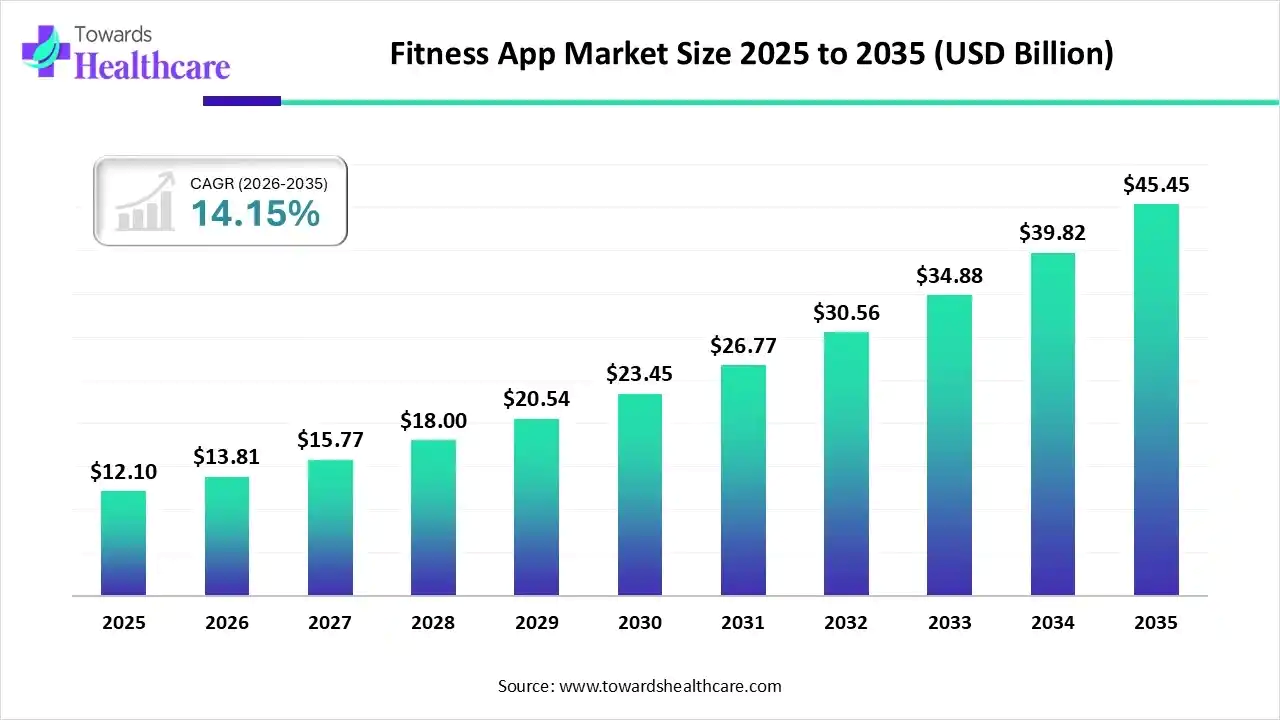

The global fitness app market size was valued at USD 12.1billion in 2025 and is predicted to hit around USD 45.45 billion by 2035, rising at a 14.15% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 18, 2026 (GLOBE NEWSWIRE) -- The global fitness app market size is calculated at USD 13.81billion in 2026 and is expected to reach around USD 45.45 billion by 2035, growing at a CAGR of 14.15% for the forecasted period.

Curious about the 14.15% CAGR momentum? Access your free sample now @ https://www.towardshealthcare.com/download-sample/6469

Key Takeaways

- Fitness App industry poised to reach USD 13.81 billion by 2026.

- Forecasted to grow to USD 45.45 billion by 2035.

- Expected to maintain a CAGR of 14.15% from 2026 to 2035.

- North America accounted for the largest share of the market in 2024.

- Asia Pacific is expected to witness rapid expansion in the studied years.

- By type, the exercise and weight loss segment was dominant in the fitness app market in 2024.

- By type, the activity tracking segment is expected to grow at a rapid CGAR in the upcoming years.

- By platform, the iOS segment registered dominance in the market in 2024.

- By platform, the Android segment is expected to witness the fastest growth in the predicted timeframe.

- By devices, the smartphones segment led the market in 2024.

- By devices, the wearable devices segment is expected to grow rapidly during 2026-2035.

Executive Summary Table

| Key Elements | Scope | |

| Market Size in 2026 | USD 13.81 Billion | |

| Projected Market Size in 2035 | USD 45.45 Billion | |

| CAGR (2026 - 2035) | 14.15 | % |

| Leading Region | North America | |

| Market Segmentation | By Type, By Platform, By Device, By Region | |

| Top Key Players | MyFitnessPal, Inc., Google (Alphabet Inc.), Nike, Inc., Under Armour, Inc., Adidas AG, ASICS Corporation, Fitbit, Inc. (part of Google), Strava, Inc., Peloton Interactive, Inc | |

What are the Emerging Advancements in Fitness App?

The fitness app market refers to a mobile application that explores tracking, managing, and boosting physical health through features such as workout logging, nutrition monitoring, guided exercises, & wearable device integration. Whereas leading firms are increasingly advancing AI to develop hyper-personalized, variable workout and diet plans based on real-time data. Alongside, the market is shifting towards virtual reality (VR) & augmented reality (AR), which creates virtual workout environments and raises motivation.

What are the Prominent Drivers in the Fitness App Market?

A crucial factor is a rise in emphasis on health, mental health, and eliminating obesity, which fuels the demand for the latest apps to track nutrition. Besides this, the rising penetration of smartphones & integration with wearables are enabling users to monitor health data in real-time. Moreover, after the pandemic, the population is demanding versatile, on-demand, and tailored, at-home workouts, with extensive virtual training.

We’re happy to help - contact us for orders or further information @ sales@towardshealthcare.com

What are the Significant Drifts in the Fitness App Market?

- In September 2025, Universal Pictures Content Group (Universal) joined with Sudor to reinforce its portfolio of wellness apps.

- In June 2025, Tolion Health, Inc. collaborated with Garmin to enable users of the Tolion Brain Coach mobile application to perfectly use their health data from the rigorous Garmin smartwatch and fitness tracker portfolio.

-

In May 2025, Fitness app Strava positioned a $2.2 billion valuation after raising a confidential amount of new funding, comprising debt.

What is the Pivotal Challenge in the Fitness App Market?

The market is facing higher user cancellation rates, exceptional competition, and data security issues. In some cases, limitations, like inaccurate sensor data, GPS, battery drain, and cheap UI/UX design, result in user frustration.

Regional Analysis

What Made North America Dominant in the Market in 2024?

North America led with a major share of the fitness app market in 2024. This is primarily fueled by a growth in the use of smartphones & wearables, such as the Apple Watch and Fitbit. Also, several American companies are implementing fitness apps into employee wellness packages to raise their adoption rates. Specifically, users in the US/Canada are prioritizing hybrid models, integrating in-person studio visits with app-based home training, demonstrated by FIIT & ClassPass.

In the U.S., fitness apps are expanding rapidly as consumers embrace digital tools for personalized workouts, mental wellness, wearable integration, and subscription services that enhance engagement and retention. Increased health awareness, technology adoption, and integration with insurance incentives are shaping broader, more holistic user experiences.

How did the Asia Pacific Grow Notably in the Fitness App Market in 2024?

Asia Pacific is predicted to expand fastest in the market. The widespread adoption is especially propelled by the increasing prevalence of obesity, diabetes, and cardiovascular diseases, particularly in China & India, which are highly demanding for preventative health tracking tools. Both countries are moving towards "connected health," where they unite directly with smartwatches and smart rings to track health parameters, including heart rate variability (HRV) & glucose levels. Trending Indian apps, such as HealthifyMe, have refined their databases to cover thousands of regional Indian meals, which enhances the accuracy of calorie monitoring for local diets.

In China, fitness applications are evolving with advanced AI personalization, wearable connectivity, social engagement, and virtual classes fueling user engagement, while rising health consciousness and smartphone penetration drive sustained growth. Community features, holistic wellness offerings, and technology partnerships highlight future opportunities.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By type analysis

Which Type Led the Fitness App Market in 2024?

The exercise and weight loss segment held the dominating share of the market in 2024. A substantial driver is the growing cases of obesity and chronic, non-communicable diseases (NCDs), which demand digital, at-home weight management measures. For this, many apps are leveraging photo food logging and linking nutrition to exercise output, while AI can guide adjustments based on metabolic patterns & food sensitivities.

On the other hand, the activity tracking segment is estimated to register the fastest expansion. The worldwide expanding awareness regarding physical and mental well-being, with the bolstering popularity of smartwatches & fitness bands are supporting real-time monitoring of steps, calories, and heart rate. However, certain apps assist through interpreting users’ mood via voice or interaction patterns to recommend either higher-intensity or more relaxed, recovery-centred sessions.

By platform analysis

Why did the iOS Segment Dominate the Fitness App Market in 2024?

In 2024, the iOS segment held a major revenue share of the market. Its dominance is impelled by increased user engagement, premium pricing, and perfect integration with the Apple HealthKit & Apple Watch ecosystem. Their trending Apple Watch is advancing with the ability to calculate the effects of the intensity and duration of workouts on the user's body over time, further supporting training and preventing overtraining.

Whereas the Android segment will expand at the highest CAGR. Firstly, the open-source nature of Android is enabling various device compatibility, extensive integration with wearables, and consistent optimization in AI & health-tracking APIs. The advanced and latest Wear OS has increased tracking capabilities, specifically enhanced heart rate accuracy and specialized running metrics. Also, the Android platform is focusing on running/cycling apps to facilitate offline mapping & monitoring directly from the watch.

By devices analysis

Which Devices Led the Fitness App Market in 2024?

The smartphones segment captured the biggest share of the market in 2024. It is driven by the broader adoption of 5G and the cost-effectiveness of these smartphones. Also, smartphones operate as central hubs for data from smartwatches and bands, which allows for real-time, comprehensive health monitoring, like tracking heart rate, sleep, & steps. Moreover, it can facilitate customized workout plans, virtual coaching, & social and visual motivation.

Furthermore, the wearable devices segment will expand fastest. Its adoption is spurred by integrated AI, advanced sensors, IoT, and rigorous, smaller, & longer-lasting batteries, which enable more accurate tracking of heart rate, ECG, & stress levels. Nowadays, these devices offer tracking of blood pressure and blood sugar to proactively manage wellness by implementing emergency alerts, which notify contacts, and ensure safety during workouts.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Revolutionary Developments in the Fitness App Market?

- In January 2026, RightLife, part of JetSynthesys, launched India’s first integrated, AI-powered, wearable-free preventive healthcare platform to convey tailored, actionable health insights without the need for wearable devices.

- In December 2025, Apple unveiled Apple Fitness Plus in India to raise access to real-time health metrics via its Apple devices.

- In October 2025, ODDS Fitness introduced the ODDS Fitness App, as India’s first AI-integrated platform that measures health and performance.

Key Players List

- MyFitnessPal, Inc.

- Google (Alphabet Inc.)

- Nike, Inc.

- Under Armour, Inc.

- Adidas AG

- ASICS Corporation

- Fitbit, Inc. (part of Google)

- Strava, Inc.

- Peloton Interactive, Inc.

- Noom, Inc.

- Calm

- Headspace Inc.

- Samsung Electronics Co., Ltd.

- Azumio, Inc.

- Sweat

- Freeletics GmbH

- Garmin Ltd.

- Sworkit Health

- Jefit, Inc.

- Polar Electro

Browse More Insights of Towards Healthcare:

The global fitness tracker market size is calculated at USD 71.93 billion in 2025, grew to USD 84.91 billion in 2026, and is projected to reach around USD 377.77 billion by 2035. The market is expanding at a CAGR of 18.04% between 2026 and 2035.

The global fitness tracker for sleep monitoring market size is calculated at US$ 7.64 billion in 2025, grew to US$ 8.88 billion in 2026, and is projected to reach around US$ 34.15 billion by 2035. The market is expanding at a CAGR of 16.15% between 2026 and 2035.

The heart rate monitor market size stood at US$ 2.74 billion in 2025, grew to US$ 2.96 billion in 2026, and is forecast to reach US$ 5.84 billion by 2035, expanding at a CAGR of 7.87% from 2026 to 2035.

The global health and wellness market size is anticipated to grow from USD 6.16 trillion in 2025 to USD 10.48 trillion by 2035, with a compound annual growth rate (CAGR) of 5.46% during the forecast period from 2026 to 2035.

The global sleep apnea devices market size is calculated at USD 5.12 billion in 2025, grew to USD 5.44 billion in 2026, and is projected to reach around USD 9.38 billion by 2035. The market is expanding at a CAGR of 6.24% between 2026 and 2035.

The global sleep disorder market size is calculated at US$ 27.67 billion in 2024, grew to US$ 30.46 billion in 2025, and is projected to reach around US$ 70.54 billion by 2034. The market is expanding at a CAGR of 10.03% between 2025 and 2034.

The global sleep trackers market size was estimated at USD 28.69 billion in 2025 and is predicted to increase from USD 30.88 billion in 2026 to approximately USD 59.90 billion by 2035, expanding at a CAGR of 7.64% from 2026 to 2035.

The global circadian rhythm sleep disorder market size is calculated at US$ 2.48 billion in 2025, grew to US$ 2.65 billion in 2026, and is projected to reach around US$ 4.69 billion by 2035. The market is expanding at a CAGR of 6.56% between 2026 and 2035.

The global anti-snoring devices market size was estimated at USD 1.92 billion in 2025 and is predicted to increase from USD 2.06 billion in 2026 to approximately USD 3.89 billion by 2035, expanding at a CAGR of 7.34% from 2026 to 2035.

The global wearable sleep trackers market size is calculated at USD 14.9 in 2024, grew to USD 16.52 billion in 2025, and is projected to reach around USD 40.83 billion by 2034. The market is expanding at a CAGR of 10.84% between 2025 and 2034. In 2024.

The digital health tracking app market size is calculated at US$ 16.11 billion in 2024, grew to US$ 18.68 billion in 2025, and is projected to reach around US$ 67.97 billion by 2034. The market is expanding at a CAGR of 15.94% between 2025 and 2034.

Segments Covered in the Report

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Platform

- Android

- iOS

- Others

By Device

- Smartphones

- Tablets

- Wearable Devices

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

From Trends to Forecasts, Get Everything You Need to Lead Confidently| Purchase Now @ https://www.towardshealthcare.com/checkout/6469

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Also Read:

https://www.towardshealthcare.com/insights/womens-health-app-market-sizing

https://www.towardshealthcare.com/insights/disease-management-apps-market-sizing

https://www.towardshealthcare.com/insights/spiritual-wellness-apps-market-sizing

https://www.towardshealthcare.com/insights/optical-genome-mapping-market-sizing

https://www.towardshealthcare.com/insights/mhealth-market-size

https://www.towardshealthcare.com/insights/diabetes-care-devices-market-sizing

https://www.towardshealthcare.com/insights/diet-and-nutrition-apps-market-sizing

https://www.towardshealthcare.com/insights/menstrual-health-apps-market-sizing

https://www.towardshealthcare.com/insights/diabetes-management-apps-market-sizing

https://www.towardshealthcare.com/insights/clinical-nutrition-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.